Grow Your Net Worth in Dubai and Minimize Tax

Dubai’s tax-free status is unique, making it the best place for wealth accumulation. With high return investment opportunities, it makes an ideal place to Grow Your Net Worth in Dubai and Minimize Tax.

As an expatriate or a local resident, these insights will provide a roadmap to financial success in Dubai.

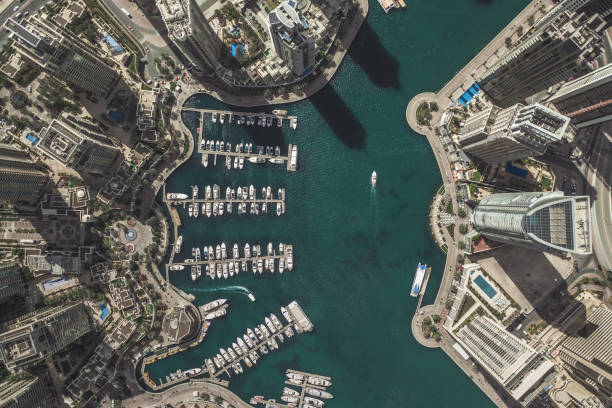

Dubai, a shining gem in the UAE, has become a beacon for individuals looking to enhance their financial portfolios while enjoying a tax-friendly environment.

Its strategic location, booming economy, and high standard of living attract professionals and entrepreneurs worldwide.

But how do you effectively grow your net worth and minimize taxes in such a dynamic landscape?

knowing the financial landscape in Dubai is crucial for anyone aiming to maximize their wealth.

Dubai offers a unique combination of tax benefits and investment opportunities, making it an ideal place for financial growth. However, strategic planning is essential to navigate this environment successfully.

Dubai’s tax-free status is one of its most appealing features, but there’s more to the story. From real estate to business ventures,

Dubai presents numerous avenues for wealth accumulation. Moreover, the legal structures available in Dubai can significantly impact your financial planning and tax liabilities.

see also; 2024 Dubai Residency Through Investment

This article will guide you through the essentials of growing your net worth and minimizing taxes in Dubai.

We’ll explore investment opportunities, wealth management strategies, and legal structures that can help you achieve your financial goals.

Whether you’re an expatriate or a local resident, these insights will provide a roadmap to financial success in Dubai.

Note worthy mentions

- Real estate and business setup are primary avenues for investment and residency.

- The Golden Visa offers a fast track to residency for eligible investors.

The Tax Environment in Dubai

Dubai’s Tax Policies

Dubai is renowned for its favorable tax environment. The emirate does not impose personal income tax, which is a significant draw for expatriates and investors.

This means that your earnings, whether from a salary or investments, are not subject to income tax, allowing you to retain more of your hard-earned money.

Benefits of Dubai’s Tax-Free Status

The absence of personal income tax is complemented by other tax benefits. There is no capital gains tax, which means that profits from investments, such as real estate or stocks, are not taxed.

Additionally, there is no inheritance tax, allowing for a smoother transfer of wealth to the next generation.

Important Considerations for Expatriates

For expatriates, understanding the nuances of Dubai’s tax system is crucial. While Dubai itself does not impose income tax, expatriates must be aware of tax obligations in their home countries.

Some countries may tax worldwide income, which can impact your overall tax strategy.

Consulting with a tax advisor who understands both Dubai’s and your home country’s tax laws can help in optimizing your tax liabilities.

Dubai, a Tax Haven for Global Investors

Dubai’s status as a tax haven is a major draw for investors seeking to optimize their wealth. Unlike many countries that impose hefty income taxes, capital gains taxes, and corporate taxes, Dubai offers a tax-free environment.

This means you retain a larger portion of your earnings, allowing for substantial wealth accumulation.

The absence of personal income tax is a significant advantage for individuals and families.

This enables you to enjoy a higher disposable income and invest more of your earnings.

Additionally, Dubai’s corporate tax holiday for the first three years of operations incentivizes business setup and growth.

Investment Opportunities in Dubai

Dubai presents a diverse landscape for investment, catering to various risk appetites and financial goals.

Real estate has been a major driver of the city’s economic growth, offering lucrative opportunities for property investors.

From residential apartments to commercial spaces, Dubai’s real estate market has demonstrated consistent appreciation.

Beyond real estate, Dubai boasts a thriving business environment across sectors such as finance, technology, and trade.

Setting up a business in Dubai can open doors to regional and global markets.

The government’s support for entrepreneurship and streamlined business setup processes make it an attractive destination for startups and established businesses alike.

the Dubai Investment Landscape

While Dubai presents immense opportunities, it’s essential to approach investments with due diligence.

Researching market trends, understanding property values, and assessing business viability are crucial steps.

Seeking professional advice from real estate agents, financial advisors, and legal experts can provide valuable insights and guidance.

Diversifying your investment portfolio is another key strategy. Spreading your investments across different asset classes can help mitigate risks and optimize returns.

Consider exploring opportunities in the stock market, mutual funds, or other financial instruments to complement your real estate or business investments.

Investment Opportunities in Dubai

Real Estate Investments

Dubai’s real estate market is one of the most attractive in the world. The city’s rapid development, coupled with its tax-free status, makes property investment highly lucrative.

Whether you’re looking for residential or commercial properties, the potential for high returns is significant.

Stock Market and Mutual Funds

Investing in Dubai’s stock market and mutual funds can diversify your portfolio. The Dubai Financial Market (DFM) and NASDAQ Dubai offer a range of investment options.

These markets are regulated and provide opportunities for both short-term gains and long-term growth.

Business Ventures and Entrepreneurship

Dubai’s strategic location and business-friendly environment make it a hub for entrepreneurship. Starting a business in Dubai can be a gateway to markets in the Middle East, Africa, and beyond.

The emirate offers various free zones with benefits such as 100% foreign ownership and zero corporate tax.

Wealth Management Strategies To Grow Your Net Worth in Dubai

Diversification of Investments

Diversifying your investments is key to managing risk and ensuring steady growth. A balanced portfolio that includes real estate, stocks, bonds, and alternative investments can provide stability and maximize returns.

Risk Management

managing risk is crucial in any investment strategy. Assess your risk tolerance and make informed decisions based on market trends and economic forecasts. Diversification, as mentioned earlier, plays a significant role in mitigating risks.

Utilizing Financial Advisors

Engaging with a financial advisor who understands Dubai’s financial landscape can be invaluable.

Advisors can provide personalized strategies that align with your financial goals, helping you navigate the complexities of wealth management in Dubai.

Legal Structures for Tax Efficiency

Offshore Companies and Trusts

Setting up offshore companies and trusts can provide significant tax advantages. These structures can help in protecting assets, reducing tax liabilities, and ensuring privacy.

Jurisdictions such as the British Virgin Islands and the Cayman Islands are popular choices for offshore entities.

Free Zones and Their Advantages

Dubai’s free zones offer numerous benefits, including tax exemptions, full foreign ownership, and simplified business setup processes.

Each free zone caters to specific industries, allowing businesses to operate in a favorable regulatory environment.

Personal Holding Companies

Creating a personal holding company can be a strategic move for managing investments and minimizing taxes.

These companies can hold assets such as real estate, stocks, and other investments, providing a layer of protection and potential tax benefits.

Navigating Financial Regulations

Compliance Requirements

Staying compliant with local and international regulations is essential for avoiding legal issues and penalties.

This includes adhering to anti-money laundering (AML) regulations, tax reporting obligations, and other compliance requirements.

Reporting Obligations

fulfilling reporting obligations is crucial for maintaining transparency and avoiding legal complications.

This includes financial reporting, tax filings, and any other regulatory requirements specific to your investments or business operations.

Legal Pitfalls to Avoid

Being aware of potential legal pitfalls can save you from costly mistakes.

Engaging with legal professionals who specialize in Dubai’s financial and business laws can help in navigating these complexities and ensuring your operations remain compliant.

Retirement Planning in Dubai

Pension Schemes Available

Dubai offers various pension schemes for expatriates and residents.

knowing these options and selecting a scheme that aligns with your retirement goals is crucial for ensuring financial security in your later years.

Long-Term Savings Plans

Long-term savings plans are essential for building a retirement fund. These plans can include a mix of investments such as stocks, bonds, and real estate, providing a steady income stream during retirement.

Tax Implications for Retirees

While Dubai’s tax-free status is beneficial, retirees must consider tax implications in their home countries.

Consulting with a tax advisor can help in optimizing your retirement strategy and minimizing tax liabilities.

Estate Planning and Wealth Transfer

Importance of a Will

Having a will is essential for ensuring that your assets are distributed according to your wishes.

It provides clarity and prevents disputes among beneficiaries, making the wealth transfer process smoother.

Trusts and Foundations

Setting up trusts and foundations can provide additional layers of protection and control over your assets.

These structures can also offer tax benefits and ensure that your wealth is managed according to your wishes.

Succession Planning

Succession planning is crucial for business owners and individuals with significant assets. Having a clear plan in place ensures a smooth transition and continuity of operations, protecting your legacy.

Leveraging Financial Technology

Digital Banking and Its Benefits

Digital banking has revolutionized the way we manage finances. It offers convenience, accessibility, and enhanced security.

Leveraging digital banking services can streamline your financial management and provide real-time access to your accounts.

Cryptocurrency Investments

Cryptocurrencies present a modern investment avenue with high potential returns. Understanding the risks and regulatory environment surrounding cryptocurrencies is essential for making informed investment decisions.

Online Trading Platforms

Online trading platforms offer access to global markets and a wide range of investment options. These platforms provide tools and resources that can help you make informed investment decisions and manage your portfolio effectively.

How can I legally minimize my tax in Dubai?

Legally minimizing your tax in Dubai involves understanding the local tax laws and taking advantage of the tax-free status on personal income and capital gains.

Consider setting up offshore companies, utilizing free zones, and engaging with financial and legal advisors to optimize your tax strategy.

What are the best investment opportunities in Dubai?

The best investment opportunities in Dubai include real estate, stock markets, mutual funds, and business ventures.

The city’s thriving property market and strategic location make it an ideal place for diverse investments. Additionally, Dubai’s free zones offer attractive conditions for business startups.

How can expatriates benefit from Dubai’s tax policies?

Expatriates can benefit from Dubai’s tax policies by enjoying the tax-free status on their income and capital gains.

However, you should also be aware of their home country’s tax obligations. Consulting with a tax advisor who understands both jurisdictions can help expatriates optimize their tax liabilities.

What should I consider when planning my estate in Dubai?

When planning your estate in Dubai, consider drafting a will, setting up trusts or foundations, and engaging in succession planning.

These steps ensure that your assets are distributed according to your wishes and provide protection and control over your wealth.

Are there any risks associated with investing in Dubai?

Like any investment, there are risks associated with investing in Dubai. These include market volatility, regulatory changes, and economic factors. Diversifying your portfolio, staying informed about market trends, and consulting with financial advisors can help mitigate these risks.

How can I legally minimize my tax in Dubai?

Legally minimizing your tax in Dubai involves understanding the local tax laws and taking advantage of the tax-free status on personal income and capital gains.

Consider setting up offshore companies, utilizing free zones, and engaging with financial and legal advisors to optimize your tax strategy.

What are the best investment opportunities in Dubai?

The best investment opportunities in Dubai include real estate, stock markets, mutual funds, and business ventures. The city’s thriving property market and strategic location make it an ideal place for diverse investments. Additionally, Dubai’s free zones offer attractive conditions for business startups.

How can expatriates benefit from Dubai’s tax policies?

Expatriates can benefit from Dubai’s tax policies by enjoying the tax-free status on their income and capital gains.

However, they should also be aware of their home country’s tax obligations. Consulting with a tax advisor who understands both jurisdictions can help expatriates optimize their tax liabilities.

What should I consider when planning my estate in Dubai?

When planning your estate in Dubai, consider drafting a will, setting up trusts or foundations, and engaging in succession planning. These steps ensure that your assets are distributed according to your wishes and provide protection and control over your wealth.

Are there any risks associated with investing in Dubai?

Like any investment, there are risks associated with investing in Dubai. These include market volatility, regulatory changes, and economic factors. Diversifying your portfolio, staying informed about market trends, and consulting with financial advisors can help mitigate these risks.

What types of businesses thrive in Dubai’s free zones?

Dubai’s free zones cater to various industries, making them ideal for a wide range of businesses. Technology firms, logistics companies, media enterprises, and financial services often thrive in these zones due to the favorable regulatory environment, tax exemptions, and the ability to retain full foreign ownership.

How do I start a business in Dubai?

Starting a business in Dubai involves several steps. First, choose a business activity and a legal structure, such as a free zone company or an offshore company. Next, register your business with the relevant authorities, obtain the necessary licenses, and set up a corporate bank account. Working with a local business advisor can streamline this process.

What are the benefits of investing in Dubai real estate?

Investing in Dubai real estate offers several benefits, including high rental yields, capital appreciation, and a tax-free environment on property income. The city’s modern infrastructure, strategic location, and strong demand for rental properties make it an attractive investment option.

Can I invest in Dubai’s stock market as a foreigner?

Yes, foreigners can invest in Dubai’s stock market. The Dubai Financial Market (DFM) and NASDAQ Dubai are open to international investors.

To start investing, you need to open an account with a licensed brokerage and complete the necessary KYC (Know Your Customer) requirements.

What are the key factors to consider when choosing a financial advisor in Dubai?

When choosing a financial advisor in Dubai, consider their credentials, experience, and reputation.

Look for advisors who are certified by recognized financial institutions and have a proven track record.

Additionally, ensure they have a deep understanding of both local and international financial regulations and can offer tailored advice to meet your specific needs.

How does Dubai’s tax-free status impact expatriates’ retirement planning?

Dubai’s tax-free status significantly benefits expatriates’ retirement planning by allowing them to accumulate savings and investment returns without the burden of personal income tax.

This means more of their income can be allocated towards retirement funds.

However, expatriates must consider potential tax obligations in their home countries and plan accordingly, often with the help of a tax advisor.

What are the advantages of setting up an offshore company in Dubai?

Setting up an offshore company in Dubai offers several advantages, including tax benefits, asset protection, and enhanced privacy. Offshore companies can also facilitate international trade and business operations.

Dubai’s strategic location and robust infrastructure make it an ideal hub for managing global business activities.

How can digital banking enhance financial management in Dubai?

Digital banking enhances financial management in Dubai by providing convenient, real-time access to accounts and transactions. It offers a range of services such as online payments, fund transfers, and investment management tools, all accessible via mobile devices.

This convenience allows for efficient management of personal and business finances, especially for expatriates and frequent travelers.

What should I know about cryptocurrency investments in Dubai?

Cryptocurrency investments in Dubai are gaining popularity, but they come with certain risks and regulatory considerations.

It is important to stay informed about the legal status and regulations surrounding cryptocurrencies in Dubai. Engaging with reputable cryptocurrency exchanges and keeping abreast of market trends and developments can help in making informed investment decisions.

What legal structures are available for asset protection in Dubai?

In Dubai, various legal structures are available for asset protection, including offshore companies, trusts, and foundations.

These structures can help shield assets from creditors, provide tax benefits, and ensure privacy. Each structure has specific legal and regulatory requirements, so it’s advisable to consult with legal professionals to choose the best option for your needs.

Final Words

Dubai’s unique financial landscape offers unparalleled opportunities for wealth growth and tax minimization.

complete knowledge of the tax environment, diversifying your investments, and utilizing strategic financial planning,

Dubai has emerged as a global investment powerhouse, offering a unique blend of economic opportunity and a luxurious lifestyle.

you can position yourself to achieve financial success and unlock the full potential of Dubai.

investing involves risks, and it’s essential to conduct thorough research and seek professional advice. However, with careful planning and execution,

Dubai can be a catalyst for your wealth growth and personal aspirations.